If America’s pantries were toured, it’s highly likely that a mix of brands would be found inside each cupboard’s doors. National brands would sit in harmony with lesser known store brands, sharing the space together. This mix and match of brands is a testament to the new normal in retail stores: store brands. And what we’ve found is consumers enjoy a combination of both store brands and national brands, depending on the product category.

Over the past few years, retailers have gotten smart. They came to the realization that somewhere between the basic and boring “generic” brands of the 1970s and the familiar, well-marketed national brands of recent years sits an opportunity for revenue. The opportunity is in the positioning of the store brand itself through private labels, private brands, house brands and retailer brands. Common store brands include 365 Everyday Value® (Whole Foods), Archer Farms (Target), Market Pantry (Target), Kirkland (Costco), Pantry Essentials (Safeway), Healthy Accents (Food Lion) and Great Value (Wal-Mart). It’s likely that you’ve never considered these brands to be a retailer brand, but more of a true brand – because that’s what store brands are becoming.

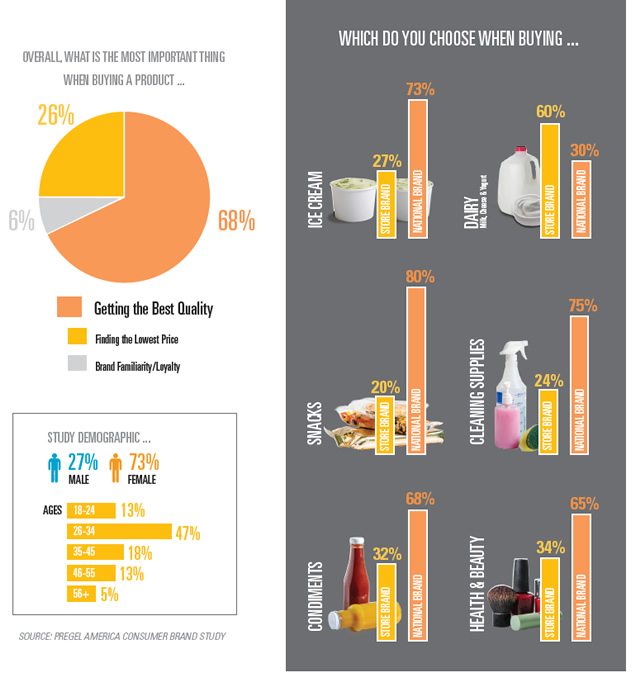

The number one myth among consumers about store products is that store brands are lower quality than national brands. This thought began years ago when “generic” products were manufactured with poor packaging, poor quality and no support from retailers. However, a recent Mintel report says that 44 percent believe store brand products are of better quality today than they were five years ago and 39 percent recommend them. In a Consumer Brand Survey PreGel AMERICA conducted with 75 people ranging in age from 23–61, 68 percent said that high quality is the most important factor in their shopping trips for food and household supplies. Survey participants were also asked whether they typically choose a store brand or national brand in six different product categories. The national brand won out in all categories except dairy products, proving that store brands need to continue working on getting their brands better known as top quality brands.

It’s human nature to judge a book by its cover, even while grocery shopping, so it’s likely if given the choice between plain, generic packaging and exciting packaging, many consumers will choose the better packaged brand. Boring packaging is another myth that store brands are busting, as retailers are channeling marketing firms such as Daymon Worldwide to create attractive packaging that helps them produce their own true brand. Take Target’s Archer Farms brand, for example. To the plain eye, Archer Farms does not appear to be a Target store brand due to its organic-looking packaging enclosing gourmet offerings. New, eye-catching packaging is transforming the way consumers see retailer brands.

When it comes to pricing, the general thought is that consumers are attracted to the lowest price. However, many consumers associate top quality with higher prices, fueling their assumption that national brands are in fact better quality than store brands. What many don’t realize is the reason for the higher price in national brands is a “marketing tax” – the money we consumers pay to cover their nationwide marketing campaigns, advertising and promotions. National brands spend billions of dollars annually to get their brand out there, while store brands’ advertising budgets are minimal, not requiring a higher price point to cover the marketing money spent, yet still offering the same great quality. In PreGel AMERICA’s

Consumer Brand Study, only five percent stated that brand familiarity and loyalty were the most important factor when it comes to shopping for food and household supplies, questioning if the billion dollars these national brands spend in marketing is worth the money.

At the same time, it’s a proven fact that consumers need an emotional connection to brands, something that national brands have done well but store brands are lacking. Douglas Peckenbaugh, editor-in-chief, PLBuyer, confirms that retailers are on the cusp of changing this with some simple, low-budget marketing. He affirms, “While some retailers have begun spending more on traditional advertising (print, broadcast), some are also doing a very good job of maximizing their digital presence via corporate/banner websites, social media networks, through digital magazines, etc. – all potentially effective promotional tactics that require less of a capital commitment.” We live in a digital world, making affordable marketing possible for brands.

It is also important that store brands continue data analysis to decipher their target market and understand shoppers’ needs. One demographic that could have much to do with the advancements in private labels is Millennials. Peckenbaugh shares that according to market research, “Millennials are not as tied to specific national brands as their parents.” Millennials are known for their sense of adventure and willingness to experiment, and they are not as brand loyal as other generations, making them a great target market for retailer brands.

From a retailer perspective, private labels are a way to set themselves apart from competitors and bring in bigger profits for retailers than national brands. Kathie Canning, editorial director, Store Brands, shares that “Many retailers are now relying on unique store brand items – items that can’t be found in competitors’ stores – to help drive traffic to their stores.” This attests that although national brands are competition for store brands, their biggest competitors are actually other retailers.

In terms of manufacturers, there are thousands of companies that manufacture products for retailers, including large national brand manufacturers that use excess space to produce store brands; small manufacturers that specialize exclusively in store brands; and retailers and wholesalers that have their own manufacturing space. Some might wonder if producing both national and store brand products is a conflict of interest for manufacturers. While there are tight contracts in place, there is also the mindset that a certain type of consumer will shop a national brand while a different type will shop the store brand. Peckenbaugh shares that if manufacturers can hit both kinds of shoppers with one product, they have incrementally increased their profits within that product category, making it a win-win for national brand manufacturers that also produce smaller store brands. Peckenbaugh also adds that because “different types of shoppers are drawn toward either a national brand or store brands in any given product category, the manufacturer is able to capture both markets within a category.” This mindset may begin to change as quality and packaging continue to blur the lines between how consumers view national brands and store brands.

Store shelves are the only place where two competing products can be side-by-side compared for price, size and packaging. While this is a great advantage for consumers, does it pose a threat to the national brands, causing these big-time names to feel the heat? Canning advises that “Store brands probably pose the greatest threat to brands that are number two and number three in the market.” Store brands likely won’t take out the Oreo® and Lays® of the world, but they may eventually cause the next tier of brands to disappear from the shelves. On the other hand, Peckenbaugh believes that “this level of competition will result in better overall products across the board at every price point.” We could see an improvement among all products as brands work to stay above the competition.

Store brands are no longer for penny-pinching consumers who don’t care about quality. Canning says that the future of store brands has already begun, as store brands are now becoming true brands, disassociating themselves from the generic brands of the past. Soon the line between store brands and national brands will become blurred with everything falling under

one category: brands.