In 2003, Ronald McDonald’s smile seemed a little sweeter when the restaurant officiallylaunched its Dollar Menu at the beginning of an economic downfall. As a response to decreased consumer spending and stock market downturn, the company sent customers diving for quarters under their couch cushions.While the craze for dollar-priced items  evolved soon after, the idea was not a McDonald’s original. In 1989 Wendy’s began offering 99 cent items while Burger King promoted its “Great Tastes” menu.Despiteits popularity in previous years, the value menu trend is starting to fade, leaving restaurant owners to find new ways to lure in customers. Several factorsare responsible, ranging from a rising economy to a demand for healthier food options. For today’s restaurant owner, this isn’t necessarily bad news; it’s an invitation for profitable innovation

evolved soon after, the idea was not a McDonald’s original. In 1989 Wendy’s began offering 99 cent items while Burger King promoted its “Great Tastes” menu.Despiteits popularity in previous years, the value menu trend is starting to fade, leaving restaurant owners to find new ways to lure in customers. Several factorsare responsible, ranging from a rising economy to a demand for healthier food options. For today’s restaurant owner, this isn’t necessarily bad news; it’s an invitation for profitable innovation

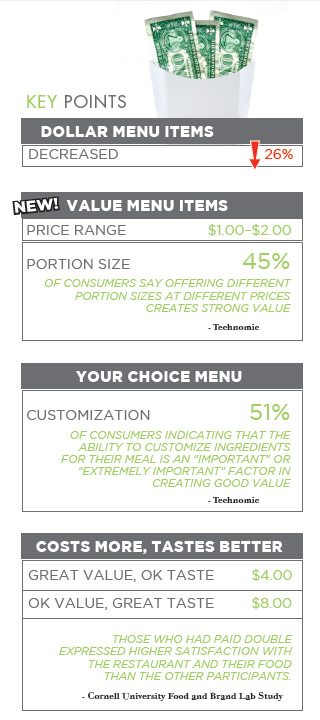

Why Value Menus Can’t SurviveAt first glance the math seems pefect; deals drive traffic andprofit is made. Howeve, more and more restaurant and franchise owners are fightingto do away with value menus that steal attention from more profitable entrees. According to a recent Mintel repot, dollar menu items have decreased by 26 percent over the past three years.This is due to higher food costs, rising labor prices and health-care costs. In an attempt to counterbalance these added expenses, restaurants have cut back in other areas such as quality, or worse, staff. These measures have not been enough to keep the value menu alive. “Because of inflation, todays dollar is worth only 77 cents in 2002 dollars,” explains Jonathan Maze in his article “Praising the Dollar Menu’s Eventual Demise.” With no other way to run, companies have revamped their offerings to include slightly costlier items.

For many, the solution has been a quick name change, such as McDonald’s move to the “Dollar Menu & More.” The new campaign includes items ranging in price from $1-$2+ dollars for items such as the Bacon Cheddar McChicken. Wendy’s has opted for the name “Right Price, Right Size Menu,” insinuating that customers are willing to pay more for what they really desire. Burger King’s “King Deals Value Menu” even includes a Bacon Cheeseburger Deluxe and Rodeo Chicken Sandwich, both significantly larger items.

Other restaurants such as McAllister’s Deli have gone for a more direct approach, targeting the growing number of customers who prefer to pay a little more for bigger meals.The popular fast-casual restaurant unveiled its line of Big Bold Sandwiches in 2013, which offered more meat in some of its sandwiches, such as the New Yorker, at a slightly higher cost. According to Mark Brandau of Nation’s Restaurant News, “McAlister’s increased the price of the New Yorker 28 percent, but orders of the sandwich increased 71 percent.” This successfully offset the increasing cost of steak while obtaining a profitable upsell. The ability to purchasegreater portions, despite the added price, is something McAlister’s consumers valued. In Technomic’s Value & Pricing Consumer Trend Report, “45 percent of consumers say offering different portion sizes at different prices creates strong value and 44 percent say offering large portion sizes does the same.” The statistics are good news for fast-casual restaurants looking to make profit throughupsells versus value menu items.

A Fascination with Choice

While customers still like a bargain, data reflects anincreasing popularity in customizable menus with the option to upgrade. Restaurants that offer “choose two” menus are experiencing wide success. People value the freedom to eat exactly what they want at a fair cost, while allowing restaurant owners to control portions. Qdoba Mexican Grill, for example, markets their Craft 2™ option as a chance to try something new. The description reads, “With Craft 2™, you can order two perfectly sized portions of our most popular dishes. It’s the best of both worlds,” a win-win solution for both the customers and the restaurant.

Chili’s also has several build your own lunch combos, ranging in price from $6-$8 dollars. Customers can select additional items such as rice and beans for a slight upcharge. Technomic’s study found that customization enhanced the perception of value, with 51 percent of consumers indicating that the ability to customize ingredients for their meal is an “important” or “extremely important” factor in creating good value. In addition, survey findings show that qualit, taste and freshness are the top three most important attributes considered in overall restaurant value.

Price Affects Taste

Customizable menus also work well in a market with an increasing demand for quality. The freedom to choose healthier ingredients far outweighs the added cost in peoples’ minds. In fact, paying more for a meal can heighten quality perception, as demonstrated in a study by Cornell University’s Food and Brand Lab. In a simple game of psychology, researchers showed that those who paid more for a meal gave better ratings than those who paid far less. The study, conducted in an all-you- can-eat New York Italian buffet, charged some participants $8 dollars for their meal, while charging others only $4 dollars. After surveying them on various aspects of their dining experience, those who had paid double expressed higher satisfaction with the restaurant and their food than the other participants. The association of quality with price is a simple psychology term known as cognitive dissonance in which the mind modifies itsbelief to justify the action. In other words, if you pay more for something then it must be better. The same is true for customizable menus, which have seen little pushback from consumers who perceive added costs as added quality. This thought process creates a lucrative window for fast-casual restaurant owners looking to dump the old profit-consuming value menu without deterring customers

Families Are Picky Consumers

Perhaps the trickiest demographic to target is that of families with kids ages 12 and under. In fact, this group has seen a steady decline in restaurant visits. Per NPD Group research, families with children made one billion fewer visits to U.S. restaurants over the past six years compared to 306 million fewer visits by adult-only parties. In the wake of the recession, families saved money by preparing meals at home and cutting back on snacks. Since then, people have sharpened their spending habits, and are thinking twice before dining out. Add the heightened focus on nutrition, and it’s no wonder why this group is the hardest to sway. The good news is that per the NPD study, the determining factor isn’t price, it’s design. The study found that 84 percent of parents are more likely to visit a restaurant if it offers a kid-friendly environment. Restaurants who are able to offer healthier meals for the right price with a comfortable atmosphere are winning over this demographic.

Although many factors are causing quick service and fast casual restaurants to re-think the value menu, the effects of inflation may just be in their favo. The higher effects of inflation on grocey stores are closing the gap between the cost of dining out and dining in. Per Mark Brandau’s findings, “Benstein Research analysts estimated that inflation for food from the grocey store would accelerate to 3.5 percent through the second half of 2014, compared with the 2.5 percent increase in inflation the analysts expected for food from restaurants.”With more people willing to consider dine-out options, now is the time to offer innovative menus that work best for both the restaurant and the consumer.